Introduction: Using AI to Predict Stock Market Trends in 2025

Using AI to predict stock market trends is transforming how retail traders approach investing. With the power of artificial intelligence, traders can now analyze massive datasets, identify hidden patterns, and make more informed decisions—faster than ever before.

Whether you’re new to trading or looking to improve your win rate, AI tools can offer a major edge. In this post, we’ll break down how AI works in market prediction, the top tools to use, and how to start applying AI-based insights today—without needing to code.

What Does AI Do in Stock Market Forecasting?

AI isn’t magic—it’s advanced pattern recognition using machine learning (ML), natural language processing (NLP), and big data analysis. Here’s how it helps:

- Identifies trends in stock prices over time

- Analyzes news, social sentiment, and earnings reports

- Detects technical signals and correlations

- Flags possible buy/sell opportunities

Best AI Tools to Predict Stock Market Trends (No Coding Needed)

You don’t need to be a data scientist to benefit from AI. Here are user-friendly tools for retail traders:

1. TrendSpider

- AI-powered chart analysis

- Automatic trendline detection

- Strategy tester for historical data

2. Trade Ideas

- Real-time market scanning

- AI assistant “Holly” suggests trades

- Backtesting and alerts

3. Capitalise.ai

- Automates trading using plain English commands

- Example: “Buy AAPL if RSI < 30 and price above 200 MA”

4. FinChat.io / ChatGPT with Plugins

- Analyze market sentiment

- Get quick summaries of earnings or news

- Ask financial questions in real-time

How to Use AI to Predict Stock Trends: A Beginner’s Workflow

Here’s how a typical AI-powered trading analysis might look:

Step 1: Pick a Stock or Sector

Use scanners (like Finviz or MarketWatch) to find high-volume or trending stocks.

Step 2: Use AI to Analyze Sentiment

Ask ChatGPT or FinChat:

“What is the current sentiment on Tesla based on news in the last 7 days?”

Step 3: Analyze the Chart with AI

Use TrendSpider or TradingView (with AI indicators) to detect:

- Trend direction

- Support/resistance levels

- Breakout patterns

Step 4: Create Rules with an AI Tool

Use Capitalise.ai to set alerts or create trading logic:

“Sell TSLA if it drops below $160 and volume spikes above average.”

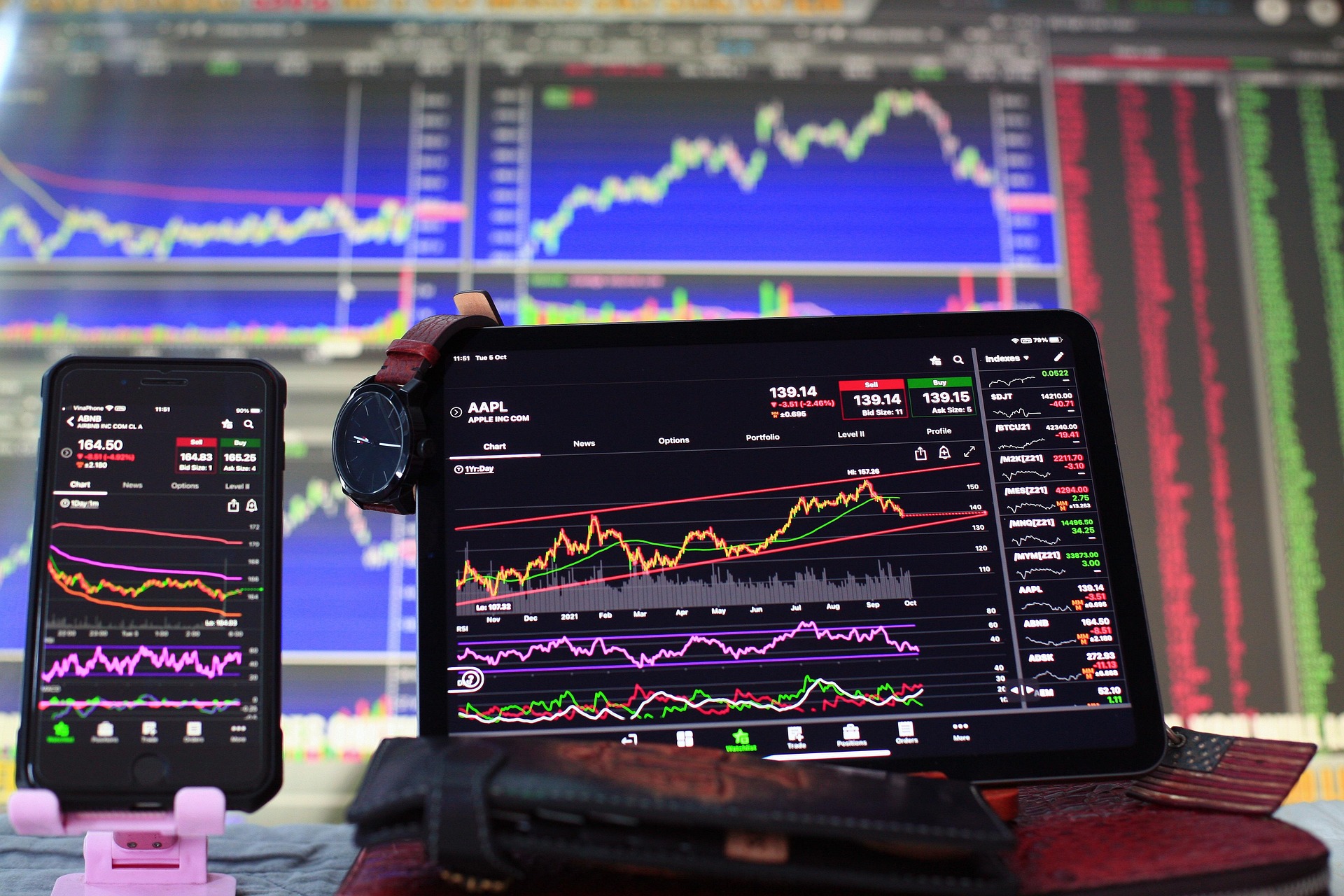

Example: AI Predicting a Tech Stock Reversal

Let’s say Apple (AAPL) is showing a steady uptrend but just hit resistance.

- ChatGPT pulls sentiment from analyst ratings and Reddit

- TrendSpider identifies bearish divergence in RSI

- Capitalise.ai sets a condition: Sell if price breaks support and MACD turns bearish

Result? A smart exit before the dip—backed by AI-driven insights.

Benefits of Using AI in Stock Trading

- Faster analysis of complex data

- Removes emotional decision-making

- Spot trends before they’re obvious

- Ideal for part-time traders and side hustlers

- Can integrate with automated trading platforms

Risks and Limitations to Consider

- AI is based on past data—not future certainty

- False signals are possible, especially in volatile markets

- Requires human judgment to validate suggestions

- Some tools have a learning curve or subscription costs

AI is a tool—not a guarantee. Think of it as a supercharged assistant, not a crystal ball.

Pro Tips for Retail Traders Using AI

- Start with demo accounts to test AI setups

- Combine technical + sentiment analysis for better signals

- Use stop-losses and risk management always

- Keep a journal of your trades and AI predictions

- Follow AI-focused trading channels or newsletters for fresh ideas

Bonus: Where to Learn More and Test Tools

| Tool | Purpose | Free Trial |

|---|---|---|

| TrendSpider | Charts & Technical AI | 7-day free |

| Trade Ideas | AI Trade Picks | Yes (limited) |

| Capitalise.ai | Rule-based automation | Free tier |

| FinChat.io | AI market chatbot | Free access |

Final Thoughts: Using AI to Predict Stock Market Trends Is the Future

In 2025, using AI to predict stock market trends is no longer a Wall Street secret. With the right tools and strategy, everyday retail traders can access data-driven insights that once required expensive software or teams of analysts.

Start small—choose a tool, analyze one stock, and track your results. As you get more comfortable, you can build a more advanced AI-assisted trading workflow that works around your time, goals, and risk level.

Remember: AI doesn’t replace you—it empowers you.

Want to explore more ways to profit from your creativity? Check out our guide on How to Create and Sell AI-Generated eBooks for another powerful income stream.